All Categories

Featured

Table of Contents

Note, however, that this does not claim anything regarding adjusting for inflation. On the plus side, also if you assume your choice would certainly be to invest in the supply market for those 7 years, and that you would certainly get a 10 percent annual return (which is far from particular, particularly in the coming decade), this $8208 a year would certainly be even more than 4 percent of the resulting small stock value.

Instance of a single-premium deferred annuity (with a 25-year deferment), with four repayment options. The monthly payment right here is greatest for the "joint-life-only" option, at $1258 (164 percent higher than with the immediate annuity).

The means you purchase the annuity will certainly identify the solution to that concern. If you acquire an annuity with pre-tax bucks, your premium lowers your taxable income for that year. According to , purchasing an annuity inside a Roth strategy results in tax-free repayments.

Long-term Care Annuities

The consultant's first action was to create an extensive monetary plan for you, and afterwards describe (a) exactly how the proposed annuity matches your total plan, (b) what alternatives s/he considered, and (c) just how such options would certainly or would not have actually resulted in reduced or higher payment for the advisor, and (d) why the annuity is the premium choice for you. - Annuity investment

Of program, a consultant may try pushing annuities also if they're not the very best fit for your situation and goals. The reason might be as benign as it is the only product they market, so they drop target to the typical, "If all you have in your tool kit is a hammer, pretty quickly every little thing starts appearing like a nail." While the expert in this situation might not be dishonest, it enhances the risk that an annuity is a bad selection for you.

What are the top Annuity Investment providers in my area?

Since annuities commonly pay the agent marketing them much higher payments than what s/he would receive for investing your money in shared funds - Annuity contracts, allow alone the no payments s/he 'd get if you purchase no-load shared funds, there is a big reward for agents to push annuities, and the extra complex the better ()

An underhanded consultant suggests rolling that quantity right into new "much better" funds that just take place to bring a 4 percent sales load. Accept this, and the advisor pockets $20,000 of your $500,000, and the funds aren't likely to perform much better (unless you picked a lot more improperly to begin with). In the same example, the expert can steer you to get a complex annuity with that said $500,000, one that pays him or her an 8 percent commission.

The advisor hasn't figured out just how annuity payments will certainly be taxed. The expert hasn't disclosed his/her compensation and/or the charges you'll be charged and/or hasn't shown you the effect of those on your eventual settlements, and/or the settlement and/or costs are unacceptably high.

Existing interest rates, and therefore predicted repayments, are historically low. Also if an annuity is ideal for you, do your due diligence in contrasting annuities marketed by brokers vs. no-load ones marketed by the releasing business.

Who should consider buying an Annuity Riders?

The stream of regular monthly payments from Social Safety is comparable to those of a delayed annuity. Considering that annuities are voluntary, the individuals acquiring them generally self-select as having a longer-than-average life expectancy.

Social Safety and security benefits are totally indexed to the CPI, while annuities either have no rising cost of living defense or at many provide a set percentage yearly boost that might or might not make up for inflation in full. This sort of rider, as with anything else that boosts the insurance provider's risk, requires you to pay even more for the annuity, or approve lower repayments.

What should I look for in an Annuities plan?

Disclaimer: This write-up is meant for educational functions just, and need to not be thought about economic guidance. You ought to consult a monetary expert before making any kind of significant financial choices. My profession has actually had several unforeseeable spins and turns. A MSc in academic physics, PhD in speculative high-energy physics, postdoc in bit detector R&D, research study position in speculative cosmic-ray physics (including a couple of sees to Antarctica), a short stint at a tiny design services company sustaining NASA, adhered to by beginning my very own little consulting technique supporting NASA tasks and programs.

Because annuities are planned for retirement, tax obligations and charges may apply. Principal Defense of Fixed Annuities. Never ever lose principal because of market efficiency as fixed annuities are not bought the market. Also throughout market slumps, your money will certainly not be influenced and you will certainly not shed money. Diverse Financial Investment Options.

Immediate annuities. Used by those that want reputable income immediately (or within one year of purchase). With it, you can tailor earnings to fit your requirements and develop income that lasts forever. Deferred annuities: For those who wish to grow their cash in time, yet want to delay accessibility to the cash until retired life years.

Secure Annuities

Variable annuities: Provides higher potential for development by spending your money in financial investment choices you select and the capacity to rebalance your portfolio based on your choices and in a means that aligns with changing economic objectives. With dealt with annuities, the company invests the funds and gives a rate of interest to the client.

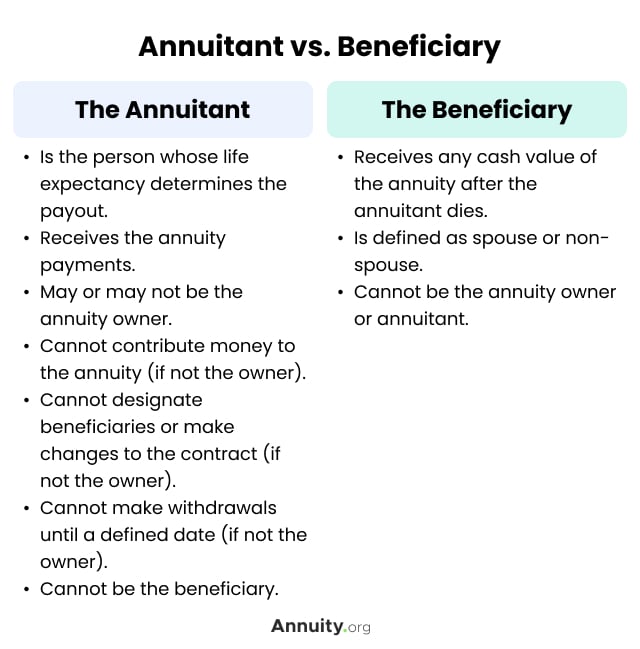

When a death claim occurs with an annuity, it is important to have a called recipient in the agreement. Various alternatives exist for annuity survivor benefit, relying on the contract and insurer. Selecting a reimbursement or "duration particular" option in your annuity provides a fatality advantage if you die early.

Who has the best customer service for Immediate Annuities?

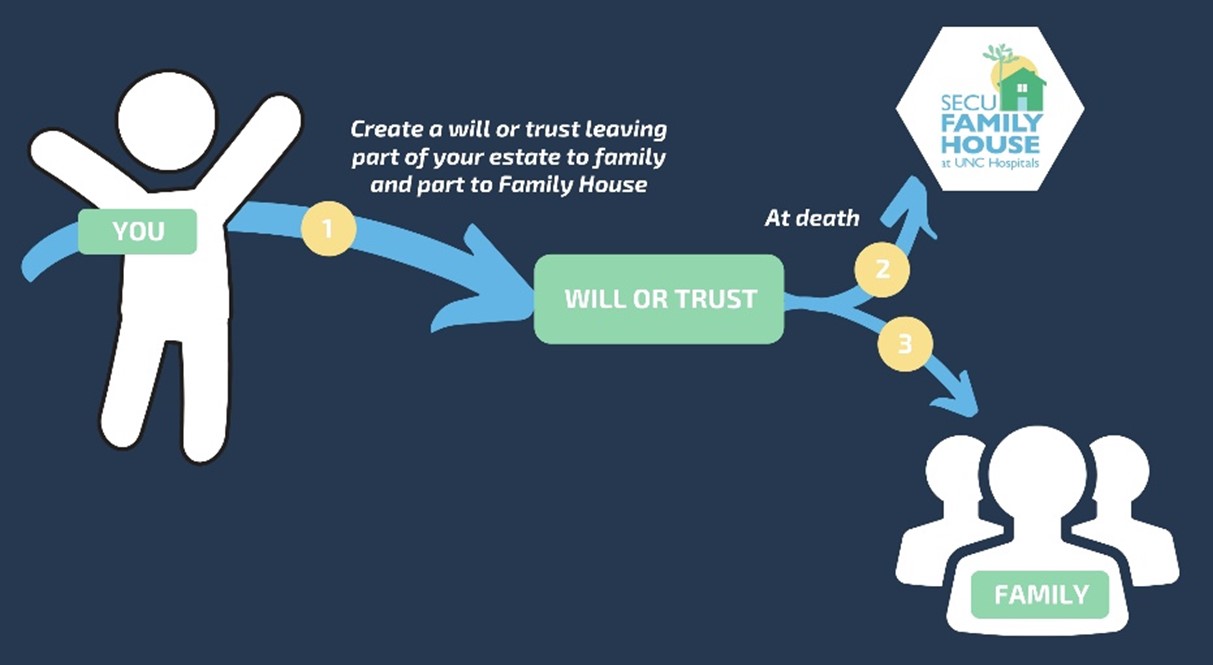

Naming a recipient other than the estate can assist this procedure go much more smoothly, and can aid make certain that the earnings go to whoever the private desired the cash to go to instead than going through probate. When present, a death benefit is immediately consisted of with your contract.

Table of Contents

Latest Posts

How do I receive payments from an Lifetime Payout Annuities?

How do I receive payments from an Annuity Accumulation Phase?

What is included in an Annuity Withdrawal Options contract?

More

Latest Posts

How do I receive payments from an Lifetime Payout Annuities?

How do I receive payments from an Annuity Accumulation Phase?

What is included in an Annuity Withdrawal Options contract?